What Best Describes the Annuity Period

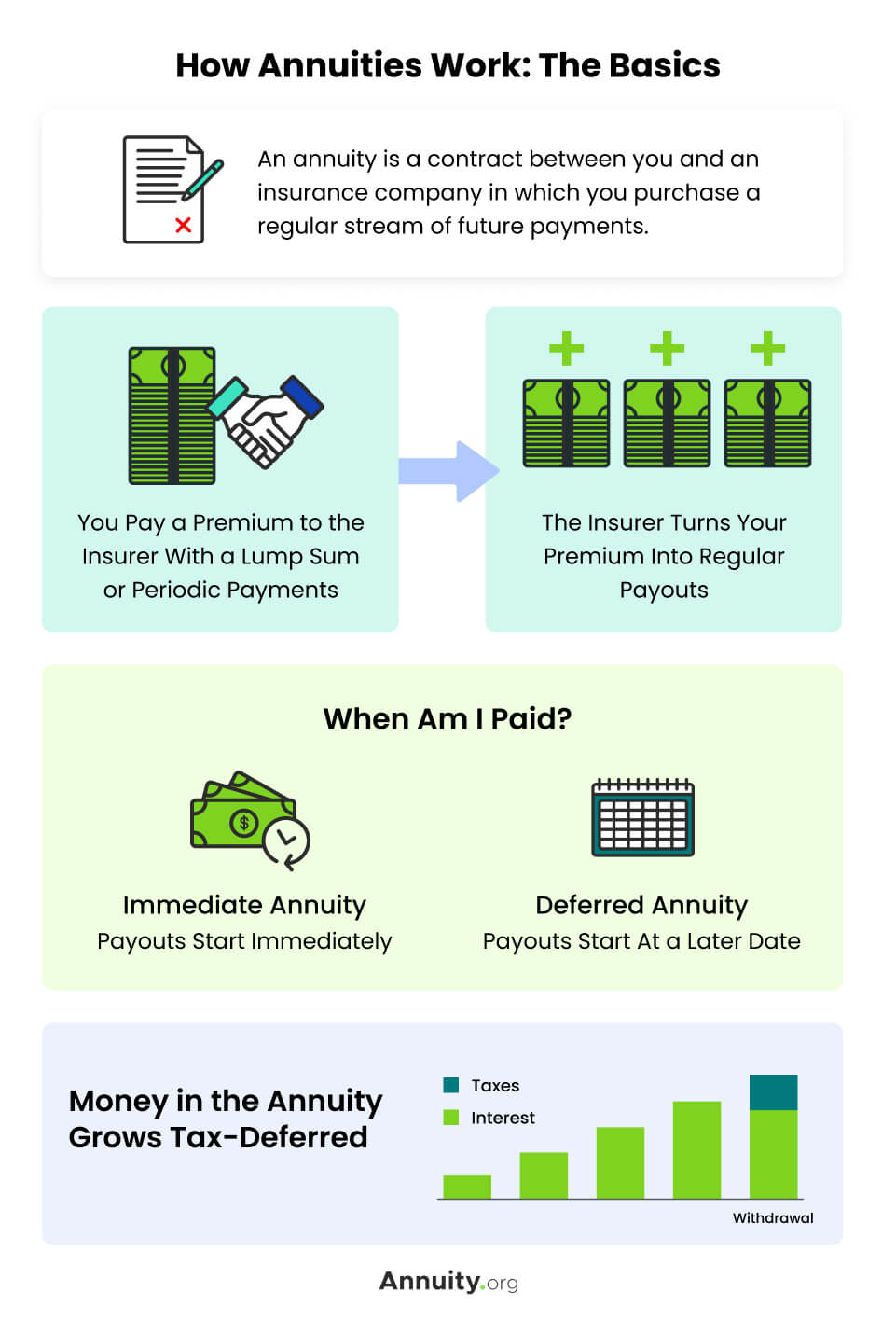

An annuity is a series of payments made at equal intervals. The cost of coverage is based on the ratio of men and women in the group.

Annuity Contracts For Investment Or For Creating Income Stream

Annuitization period An organization that in addition to other activities provides a formal insurance plan to its members is classified as a.

:max_bytes(150000):strip_icc()/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

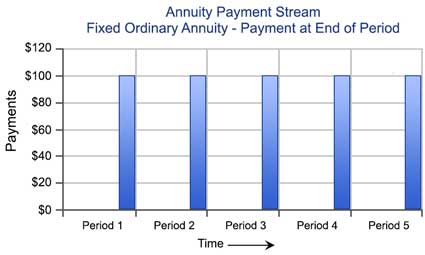

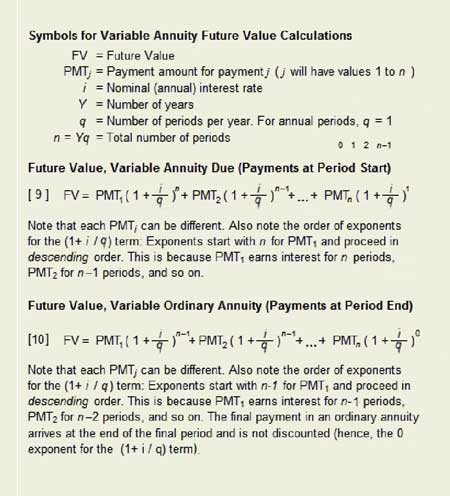

. PERIOD 1 Which of the following terms best describes an annuity due. Which of the following best describes what the annuity period is. Which of the following statements best describes an ordinary annuity.

C The period of time during which money is accumulated in an annuity. An annuity owner is funding an annuity that will supplement her retirement. A The period of time during which accumulated money is converted into income payments.

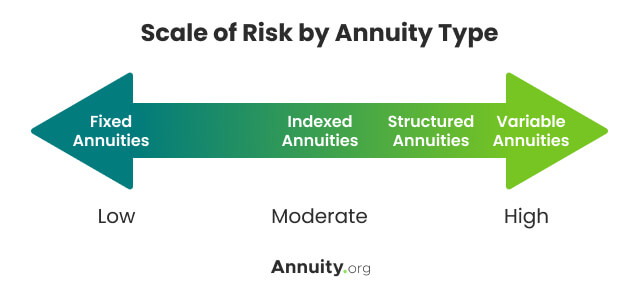

The type of annuity and the details of the particular annuity can determine. A series of payments to be received during a period of time. An employer offers group life insurance to its employees for the amount of 10000.

A series of payments to be received at a common interval during a period of time. In a growing ordinary annuity payments or receipts occur at the end of each period. Period of time from effective date of contract to the date of its termination.

A series of payments or receipts occurring over a specified number of periods that increase each period at a constant percentage. A The period of time during. It is a common question for annuity holders to wonder what the nonforfeiture value of an annuity is.

The time period depends on how often the income is to be paid. The annuity period is. The annuity period is the time during which accumulated money is converted into an income stream.

1 answer below. Your client plans to. In the alternatives previously explored benefits end upon the death of the retiree and spouse regardless of how short or long a period of time they are received.

Annuity payments can be structured for 20 years certain or other termperiod certain payouts. A fixed period annuity pays an income for a specified period of time such as ten years. It has the following characteristics.

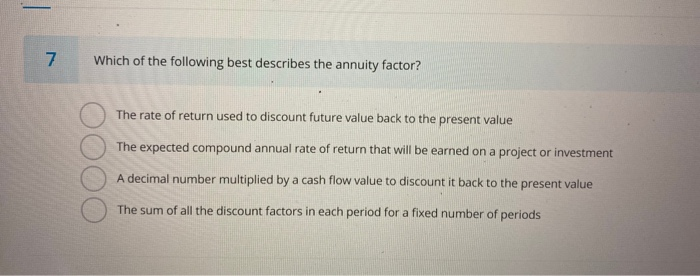

Violation of unfair discrimination law may result in all of the following penalties EXCEPT. The annuity period is the period during which the total accumulated money is paid as a fixed amount in streams in the annuitization phase. An annuity due is a repeating payment that is made at the beginning of each period such as a rent payment.

The present value of a set of payments to be received during a future period of time. Which of the following best describes what the annuity period is. Examples of annuities are regular deposits to a savings account monthly home mortgage payments monthly insurance payments and pension payments.

Equal cash flows at equal time intervals for a specific time period. Fines of up to 1000 for each act. Any growth on your investment will accrue tax-deferred.

Also which is more valuable ordinary annuity or annuity due. Equal cash flows at equal time intervals forever. All payments are made at the same intervals of time such as once a month or year.

Lumpy cash flows at equal time intervals forever. In a period certain annuity such as a 10-year certain annuity. Because she doesnt know what effect inflation may have on her retirement dollars she would like a return that will equal the performance of the SP 500.

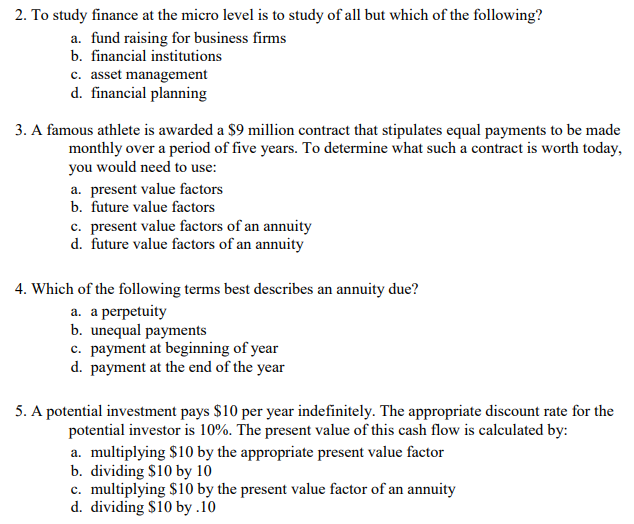

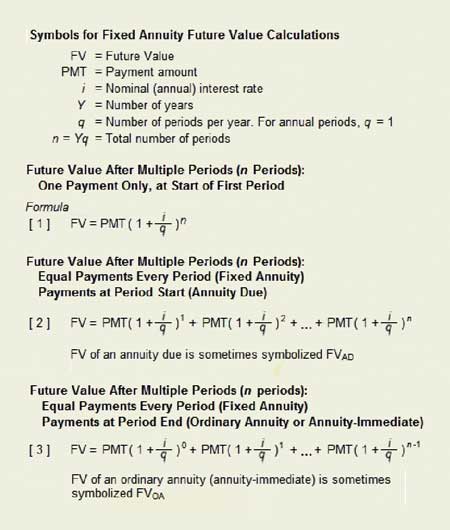

In an annuity the accumulated money is converted into a stream of income during which time period. Annuities are essentially insurance contracts. An ordinary annuity is a series of equal payments made at the end of each period for a fixed period of time.

A series equal payments to be received at a common interval during a period of time. Lumpy cash flows at equal time intervals for a specific time period. During the accumulation phase your funds are invested in fixed or variable accounts that you choose.

View FINANCIAL-MARKET-REVIEWERpdf from LAW 1 at University of Pangasinan. What Annuity is best if you are dying and you want to guarantee payments to spouse for 20 years. The final alternative is a hedge against the early death of a retiree and spouse.

In a growing annuity due payments or receipts occur at the beginning of each period. Either the amount paid into the plan or the cash value of the plan whichever is the greater amount Term. Annuity Period Defined The annuity period is the time when an annuitant person who owns the annuity starts to receive payments.

An annuity that requires immediate payment at the start of each period is known as an annuity due. An annuity due can be compared to an annuity that pays out at the end of each period. This is generally in retirement and payments can come monthly quarterly or annually.

Which of the following best describe an annuity due. It is the period of growth for the annuity that begins after the initial investment is made. Rent is an example of an annuity payment that is due on a.

All payments are in the same amount such as a series of payments of 500. Secondly how is an annuity paid out. The amount that is paid doesnt depend on.

An annuity which provides for payments for the remainder of a persons lifetime is a life annuity. This guide will discuss the definition and meaning of this term as well as how it can be calculatedWe will also provide some examples of how this figure may change over time which you may find useful when determining your own needs in retirement. B The period of time spanning from the accumulation period to the annuitization period.

For example if the income is monthly the first payment comes one month after the immediate annuity is bought. You pay a set amount of money today or over time in exchange for a lump-sum payment or stream of income in the future. The time during which accumulated money is converted into an income stream.

In an annuity the accumulated money is converted into a stream of income during which time period.

Ordinary Annuity Vs Annuity Due Smartasset Com

11 1 Fundamentals Of Annuities Mathematics Libretexts

Solved If You Need 5 000 In 4 Years Time And Your Chegg Com

11 1 Fundamentals Of Annuities Mathematics Libretexts

Solved 2 To Study Finance At The Micro Level Is To Study Of Chegg Com

Period Certain Annuity What It Is Benefits And Drawbacks

Annuity Contracts For Investment Or For Creating Income Stream

Annuity Contracts For Investment Or For Creating Income Stream

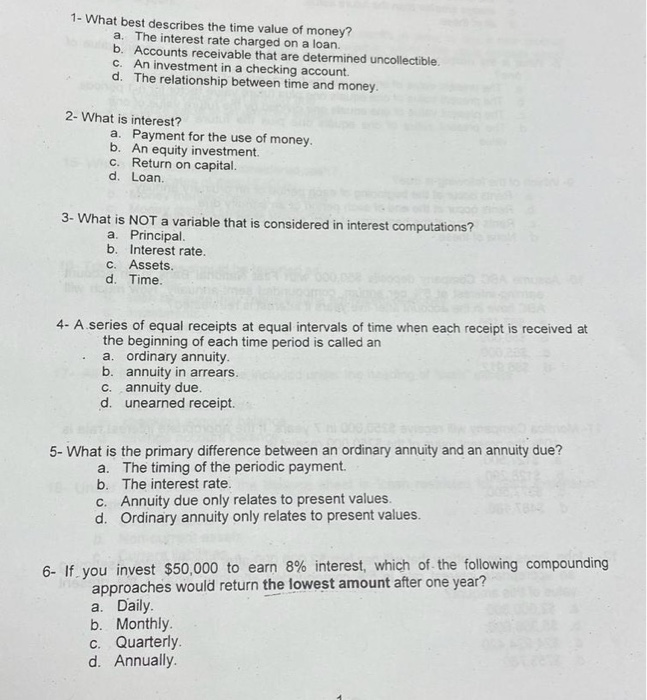

Solved 1 What Best Describes The Time Value Of Money A Chegg Com

Annuity Contracts For Investment Or For Creating Income Stream

Types Of Annuities Understanding The Different Categories

Annuity Payout Options Immediate Vs Deferred Annuities

Annuity Contracts For Investment Or For Creating Income Stream

How Annuities Work Examples By Type Considerations

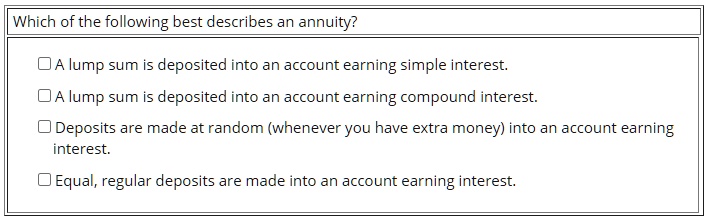

Solved Which Of The Following Best Describes An Annuity Oa Lump Sum Is Deposited Into An Account Earning Simple Interest Oa Lump Sum Is Deposited Into An Account Earning Compound Interest Deposits Are

/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

:max_bytes(150000):strip_icc()/FVAnnuityDue-d5efc75568614c3395d63f61357168c0.jpg)

/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

Comments

Post a Comment